Moneyness In The Digital Age

Introduction

Crisis decision-making in the wake of the Silicon Valley Bank (SVB) run has called into question the status of banking as a public-private partnership, as the government is now implicitly providing an infinite public backstop for private credit monies. This is an awkward way to address age-old issues related to the relationship between money and credit.

The events surrounding SVB involved a very specific and narrow set of circumstances unrelated to crypto, but they set a backdrop for a nuanced public discussion regarding moneyness in the digital age — and crypto’s vital role in the future.

Money is deeply hierarchical

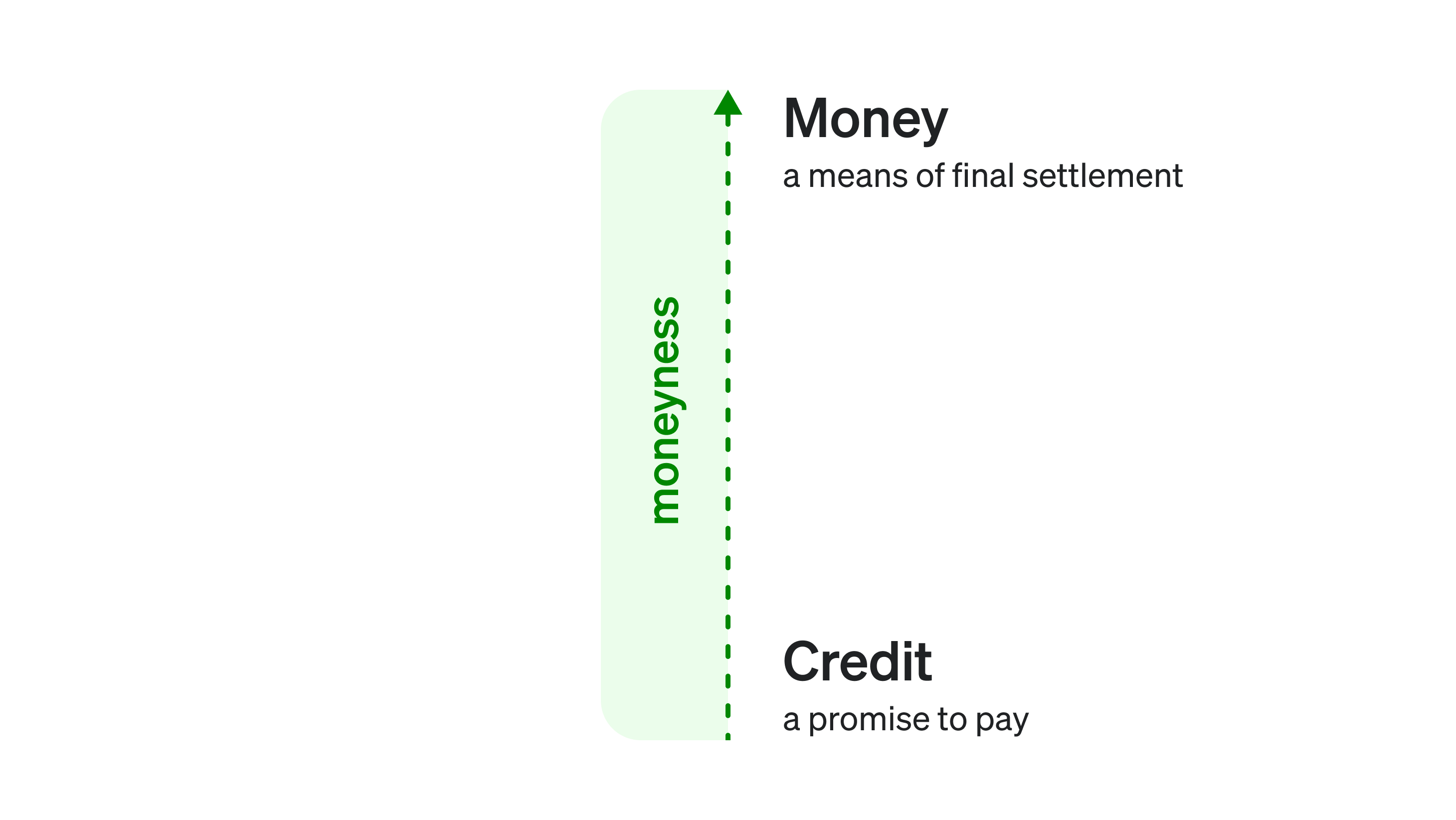

At the top of the hierarchy is money — a means of final settlement. At the bottom of the hierarchy is credit — a promise to pay, or to “settle” using a higher-order form of money at a later point in time. “Moneyness” is the degree to which a given instrument is near the top of the hierarchy, which itself has many layers.

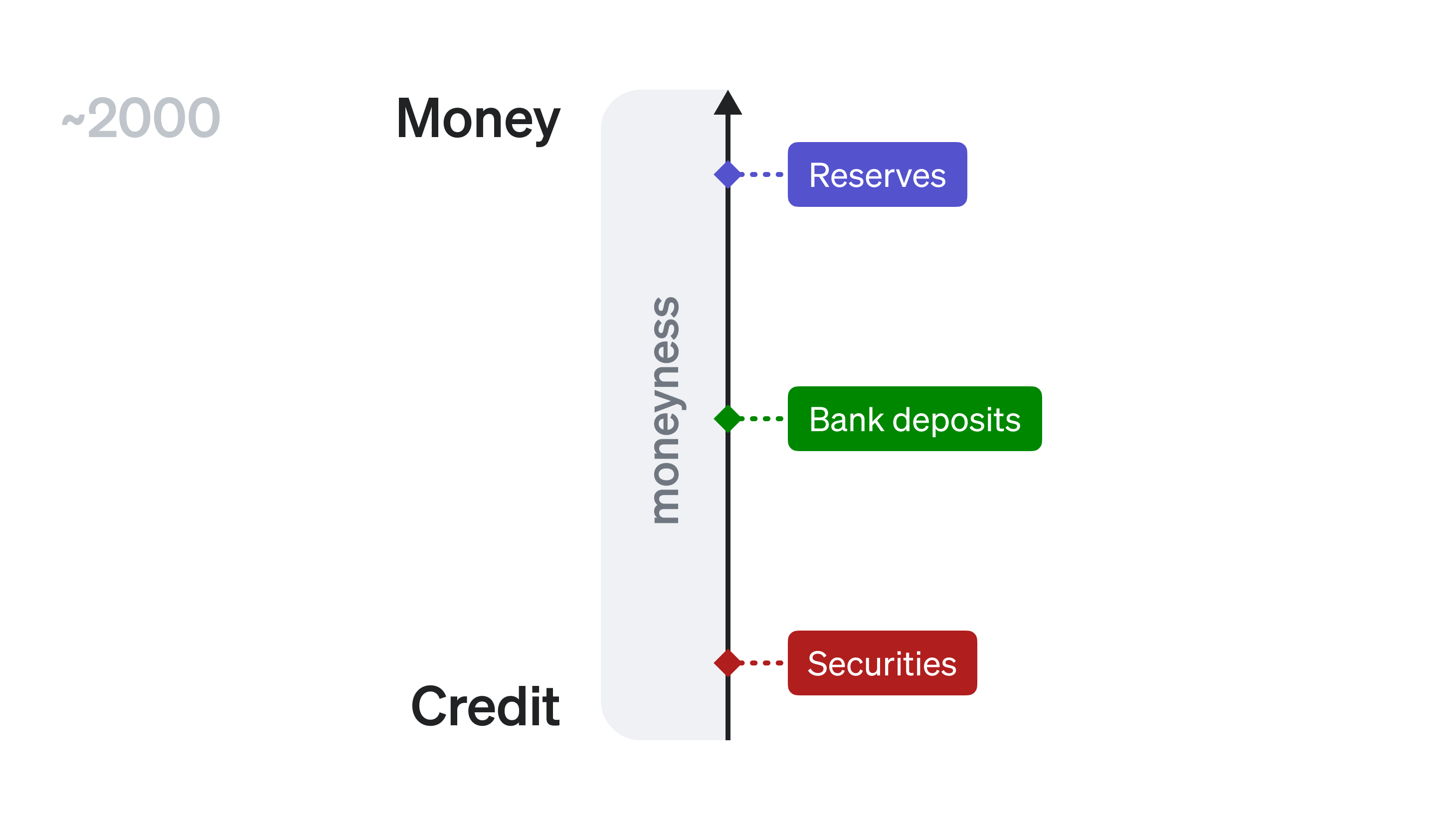

Today, liabilities issued by central banks are often treated as the ultimate form of money. These come in two main subsets: cash (a physical liability accessible to everyone) and central bank reserves (a digital liability accessible mainly to banks and nation states). Both are a claim on the asset side of the central bank’s balance sheet. In the case of the U.S. Federal Reserve, the assets are mostly U.S. government bonds. In practice, nobody tries to exercise these claims by “redeeming” their cash or reserves for Treasury securities because cash and reserves are widely accepted as a medium of exchange, unit of account, and store of value on their own. They have a high “moneyness” score today.1

Below cash and reserves in the hierarchy sits deposits issued by commercial banks. Commercial bank money is a promise to pay higher-order money — namely cash or reserves. From the perspective of most users, it is considered money and not credit thanks to deposit insurance, bank supervision, and the central bank as a lender of last resort. But, at the end of the day, commercial bank deposits are just liabilities issued by a commercial bank. They are a claim on the commercial bank’s assets, where depositors are effectively loaning money to the commercial bank — and exposed to credit risk as a result. If the bank’s assets are not worth more than its liabilities, the money it issues may not be worth what people think it is.

There are additional forms of credit-based money below deposits in the hierarchy, such as securities, which are an even more attenuated promise to pay a higher-order form of money on the hierarchy. Certain types of securities form the basis of the shadow-banking sector.

Societal notions of moneyness are constantly evolving, as is the relationship between money and the state

The monetary hierarchy has changed dramatically over time and space. Even at a single point in time there are many different hierarchies that represent an accurate relationship between money and credit, depending on a person’s perspective. In effect, a person’s relationship to other people and the economy as a whole can change how they rank the “stack” in the hierarchy.

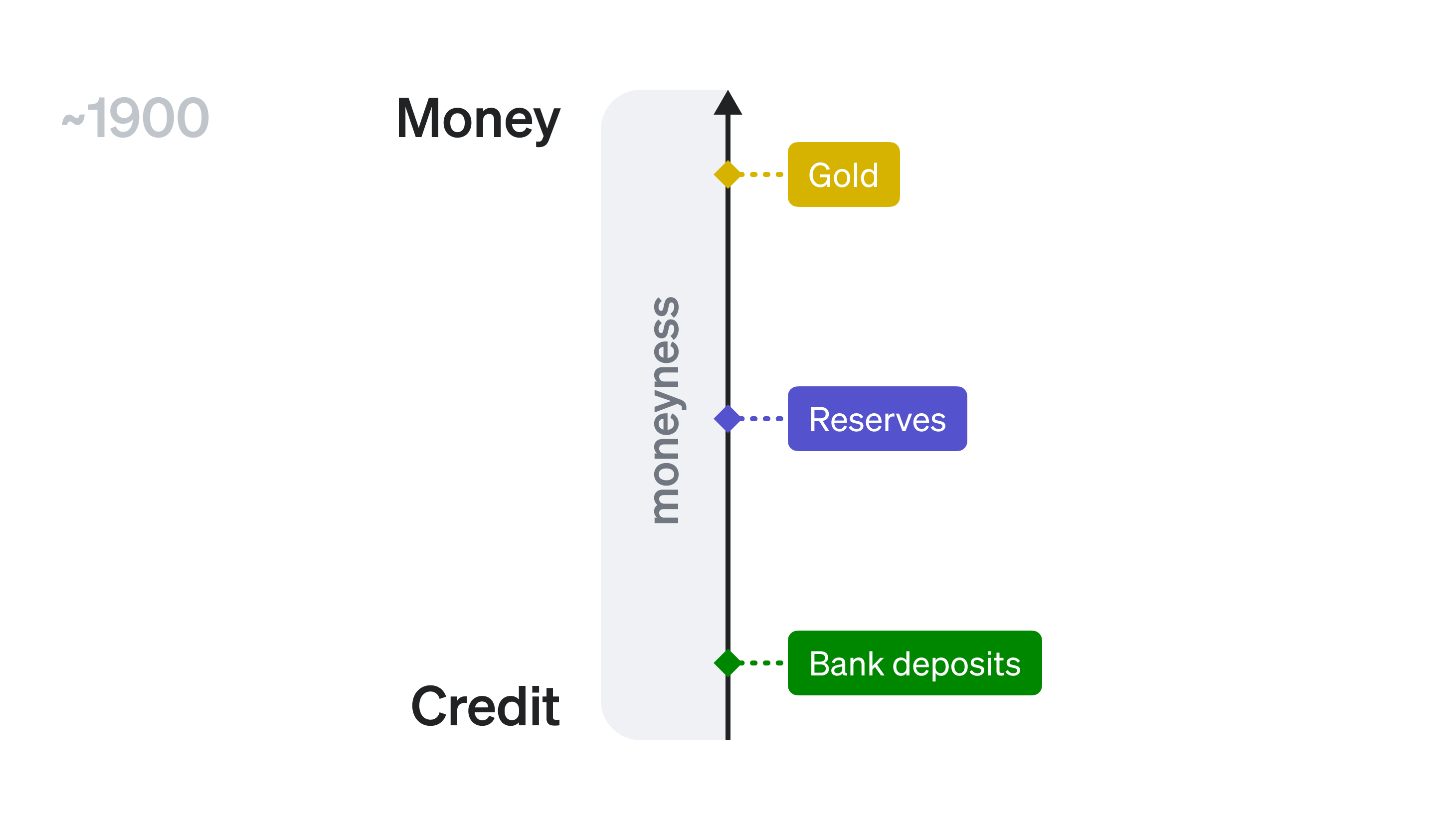

For a long time, gold was widely considered to be at the top of the moneyness chart due to its limited supply making it a useful store of value. Cash and central bank reserves used to be a legal promise to pay the holder a certain fixed amount of gold. During WWI and the immediate years following, the U.K. and other European countries went off the gold standard (weakened the promise to pay gold) while the U.S. kept it, resulting in massive flows of gold into the U.S. (and out of London) as a result. Although the U.S. temporarily abandoned the gold standard during the Great Depression, the prior moves had already set the stage for USD dominance through WW2 and the onset of the Bretton Woods System. Monetary regime decisions often have geopolitical implications.

The gold standard was abandoned in the 1970s due to constraints it placed on the ability of governments to respond to economic conditions. When money supply is inelastic (due to limits on the availability of gold), policymakers have limited tools for adjusting the price of credit to respond to economic expansions or contractions. Gold also has limited industrial uses, which makes its value almost entirely derived from its scarcity and a belief that it has value.

The current system where money is backed by the government’s ability to issue debt and collect tax revenue — a nontrivial assumption in the broader historical context — is inherently more credit-based by design. It lets the state define and control moneyness, which has both benefits and drawbacks.

Commercial bank money, today

Throughout most of our lifetimes, banking has existed as a public-private partnership. Banks operate in the private sphere with privileged public guarantees. Such guarantees enhance the safety and efficiency of money, but they also create a false sense of security and “oneness” of money. As standard practice, most people do not consider the creditworthiness of their commercial banks. Same with many large, non-bank financial institutions — sometimes with catastrophic implications.

For many, the run on SVB was a collective awakening to the notions that: 1) commercial bank deposits carry credit risk, and 2) that credit risk is nonzero. If the story had ended with SVB and Signature failing absent emergency actions by the U.S. government, we would be back at the status quo having learned a painful but in some ways unoriginal lesson. However, by stepping in and using emergency powers to guarantee all uninsured deposits, the U.S. government loosened over a century of norms and legal guardrails. During the Great Financial Crisis (GFC), the deposit insurance limit was temporarily raised from $100k to $250k (before the change was made permanent in law), but uninsured depositors did lose money in the aftermath when banks, such as IndyMac, failed.

The new policy of the U.S. seems to be, in practice, drifting towards one where individuals and businesses are not exposed to commercial bank credit risk — that broad access to a higher level of “moneyness” may be socially optimal. If that is indeed the new direction of policy for money and banking, it should be implemented in a more transparent and deliberate manner.

Moneyness in the digital age

Too often the social media discourse around moneyness and crypto can devolve into a binary purity test: crypto is good, and fiat is bad. We think this framing misses a lot of nuance.

Credit-based money has brought a certain level of prosperity and has given governments more flexibility for manipulating financial conditions to control economic growth and pursue geopolitical objectives. We also acknowledge that this is a privileged perspective coming from a liberal democracy with unmatched global power, however, and there have been some unhappy consequences of this regime.2

At the same time, there are numerous examples of how the world is changing around us.

- China’s geopolitical ascension and Russia’s invasion of Ukraine (and subsequent removal from the USD system) have had profound implications for international finance. The end of dollar dominance is far from guaranteed, but in all likelihood some stealth erosion of the USD’s share of international trade will lead to a more multipolar world — meaning that the USD and USD-denominated assets may not be as widely accepted as the ultimate form of money in the future.

- The rise of AI will substantially change the nature of economic growth and productivity. It is not hard to imagine a world where autonomous agents engage in economic activity and need a digitally-native form of money they can access without having to analyze complex and often opaque chains of credit intermediation. In addition, development of AR/VR and the growth of digital worlds means more activity takes place in digital environments.

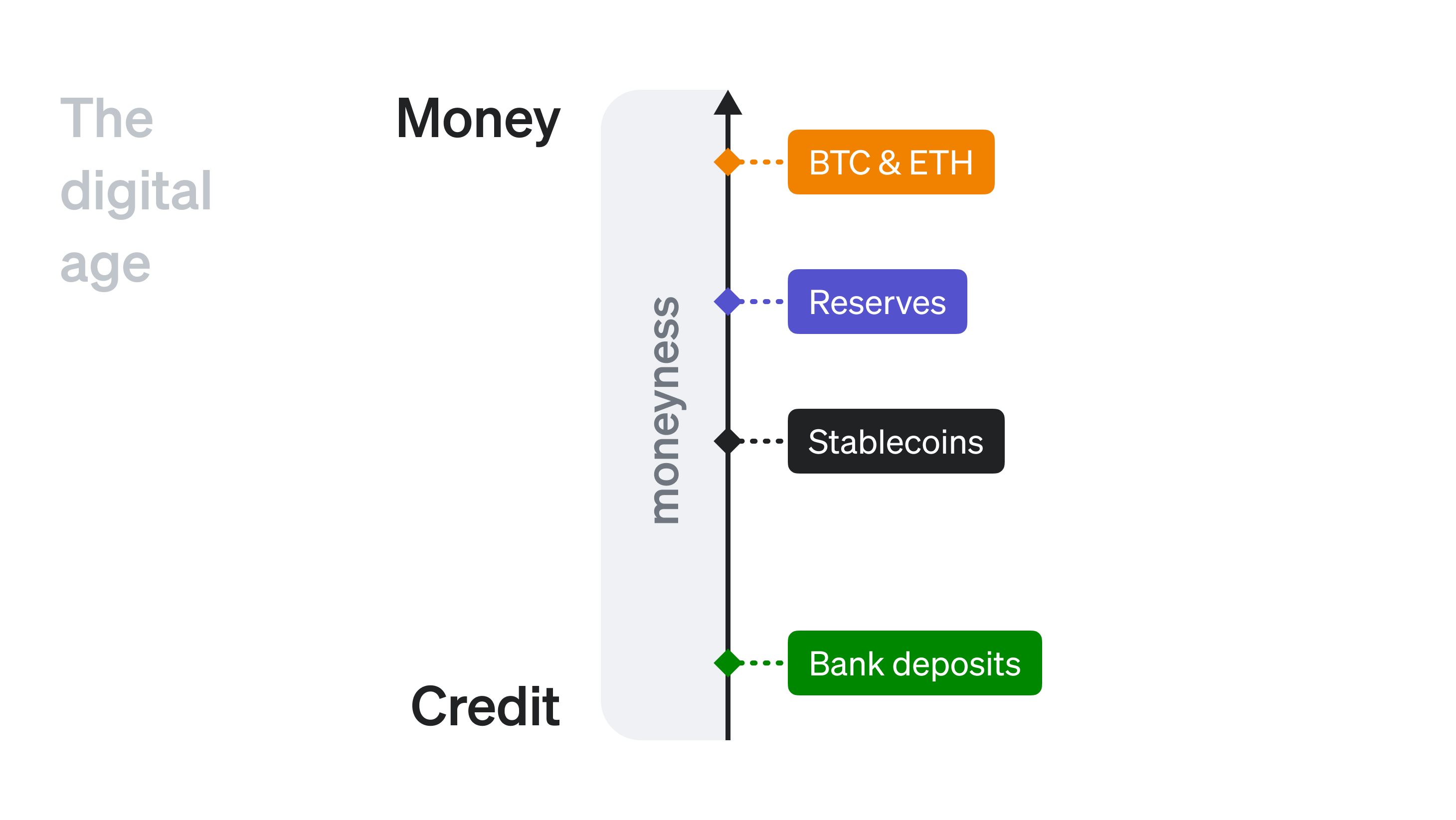

- Fiscal and monetary policy in the years following the GFC and COVID-19 created numerous distortions in the hierarchy of money. The supply of money-like securities (e.g., U.S. government securities) grew dramatically, as did the scope of implicit and explicit guarantees backing such securities and leading to further growth in the shadow-banking sector. Today, much of trade and finance relies on extensive credit intermediation via shadow banking.

- Ubiquitous connectivity and low barriers to sharing information via social media have exacerbated the speed and magnitude of financial volatility, as evidenced by the Gamestop and SVB sagas. Transparency of financial solvency is more vital now than ever.

Determining what has value has never been more challenging, nor has it ever been more important. Being thoughtful about the future of digital moneyness is critical for human progress and for states that support freedom from authoritarianism.

Crypto is hard, digital money

Much has been written about the volatility of crypto and how its volatility and “lack of intrinsic value” makes it a poor form of money. These takes are usually written with a specific conclusion in mind and often miss context of the current moment. They are also wrong.

Crypto has intrinsic value. Bitcoin has been around for more than 10 years and is actively used as a global settlement layer for censorship-resistant transactions. Ether powers the Ethereum network, a globally-distributed computer on top of which thousands of products and services have been built. If oil and coal powered the industrial revolution, ether and other native cryptocurrencies may power the next 100 years of innovation.

On top of these facts sits an even more important truth. Crypto is hard, digital money, by design. By this we mean that what crypto may lack in stability, it makes up for in being verifiably free of credit risk depending how it is held.

Maybe it’s time to “replace creditworthiness with collateralworthiness,” since time and time again people and institutions seem unable to manage counterparty credit risk when it comes to pricing their “dollars”. Crypto collateral can be volatile, but it’s easier to mark-to-market your collateral when its price is based on liquid market prices (on- and off-chain) and not obscured by an invisible balance sheet. For many applications, this could be an improvement over the status quo.

It’s equally important that people (and machines) continue to have access to digital money — free of credit risk and free of censorship — in the future. Crypto has already delivered this, and arguments about volatility and lack of a compelling use case are entirely missing the point.

Stablecoins

For many uses today, there is a need for a safe version of digital dollars. After the SVB/Signature incident there have been numerous proposals for permanently expanding individuals’ access to money with a higher moneyness factor, including unlimited deposit insurance and CBDC. These options, if considered, should be done so in a fair and public process.

In the short term, a clear improvement over the current state would be developing a clear and reasonable framework for fiat-backed stablecoins, which are already used today to provide functional digital money on top of credible collateral.

Well-designed stablecoins could give retail users and businesses a meaningful asset for managing payments (both domestic and cross-border) and storing value without exposing them to commercial bank credit risk. The MMF industry serves a similar set of purposes today, but nobody treats MMFs as money because they are not functionally built to serve as payments instruments. Effectively-designed stablecoins could serve a purpose similar to CBDC, but would retain the current relationship between individuals’ economic activity and visibility from the government in addition to carrying less operational and execution risk. Other jurisdictions, such as the U.K. and Europe, are already along this path, and it is time for the U.S. to step to the plate.

Although many details still need to be sorted, it is encouraging to see Congress considering legislation that would solidify the role of stablecoins in the digital economy.

Conclusion

For most Internet-native people, SVB was the first bank failure with significant resonance, and the first major event that spotlighted the role of private credit in underpinning our current system of money. As revealed by decisions made following the events that led to SVB’s deposit outflows, there is a renewed public focus on the potential need to reduce both the role of credit in money creation and the lack of transparency around credit-based monies. Crypto and stablecoins are limited in their reliance on credit, which makes them an attractive option for many applications in today’s interconnected digital world.

Notes

Footnotes

-

U.S. government debt is conceptually a claim on future government cash flows vis-a-vis collected tax revenue. The riskiness of government debt is predicated on the government’s ability to collect taxes in the future and the assumption that the purchasing power of the dollar in real terms will not erode over time. Testing these assumptions is beyond the scope of this paper. ↩

-

For example, the current model of USD dominance requires the U.S. to run persistent current account deficits, which requires large amounts of fiscal and household debt and has the downstream effect of eroding the U.S. manufacturing base and bargaining power of workers. ↩