Crypto's Biggest Skeptics are EVM-pilled

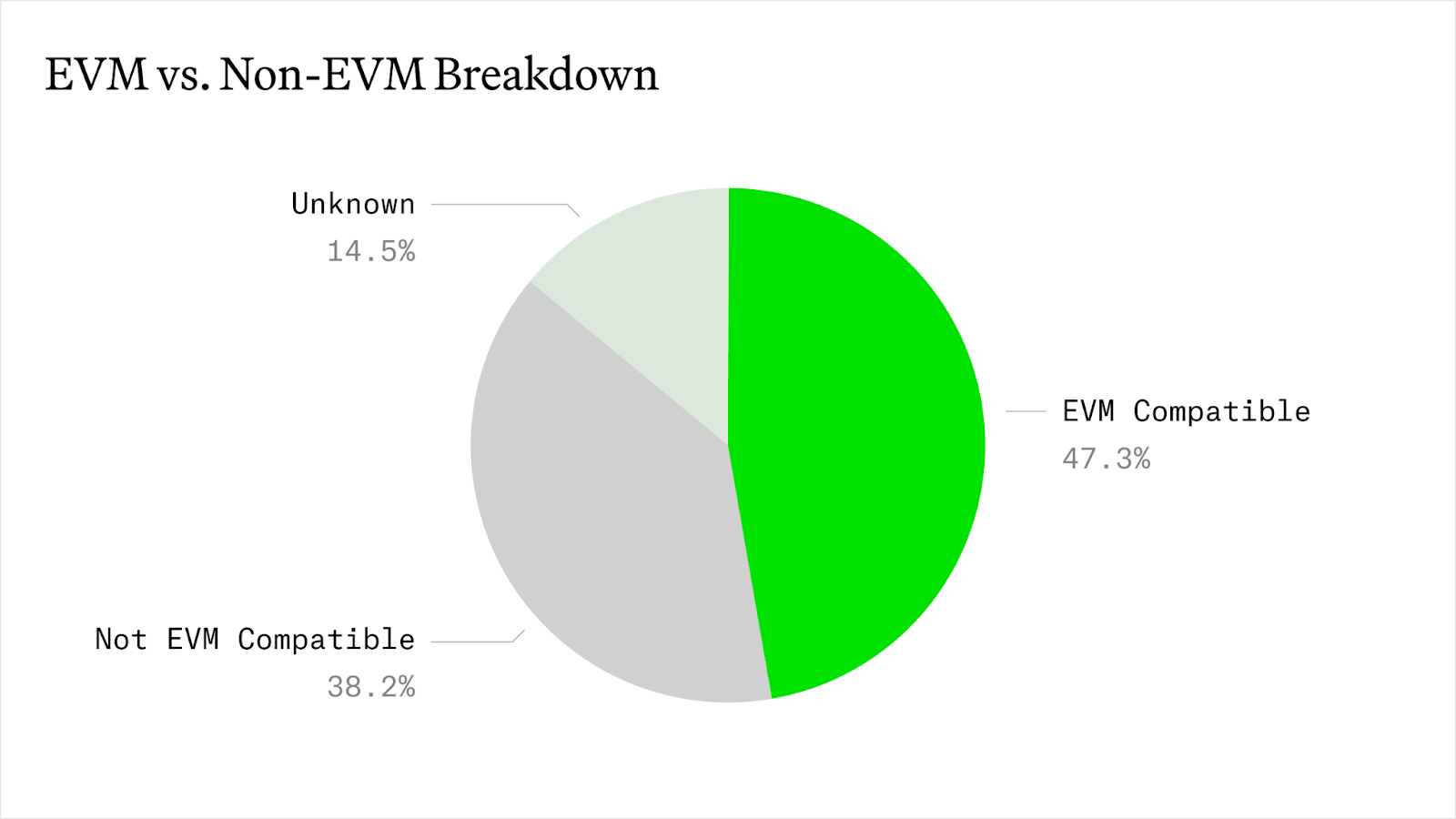

We collected data on 63 blockchain-related experiments led by G20 central banks. We found that a substantial amount of projects (47% of our sample) across different use cases (e.g., CBDC, tokenization, DeFi, etc.) are compatible with the Ethereum Virtual Machine (“EVM,” in other words, based on Ethereum’s technology stack). In addition, an increasing number of projects are being launched on public blockchains, proving that public, permissionless infrastructure is not incompatible with the needs of regulated institutions.

Our findings underscore a few important things:

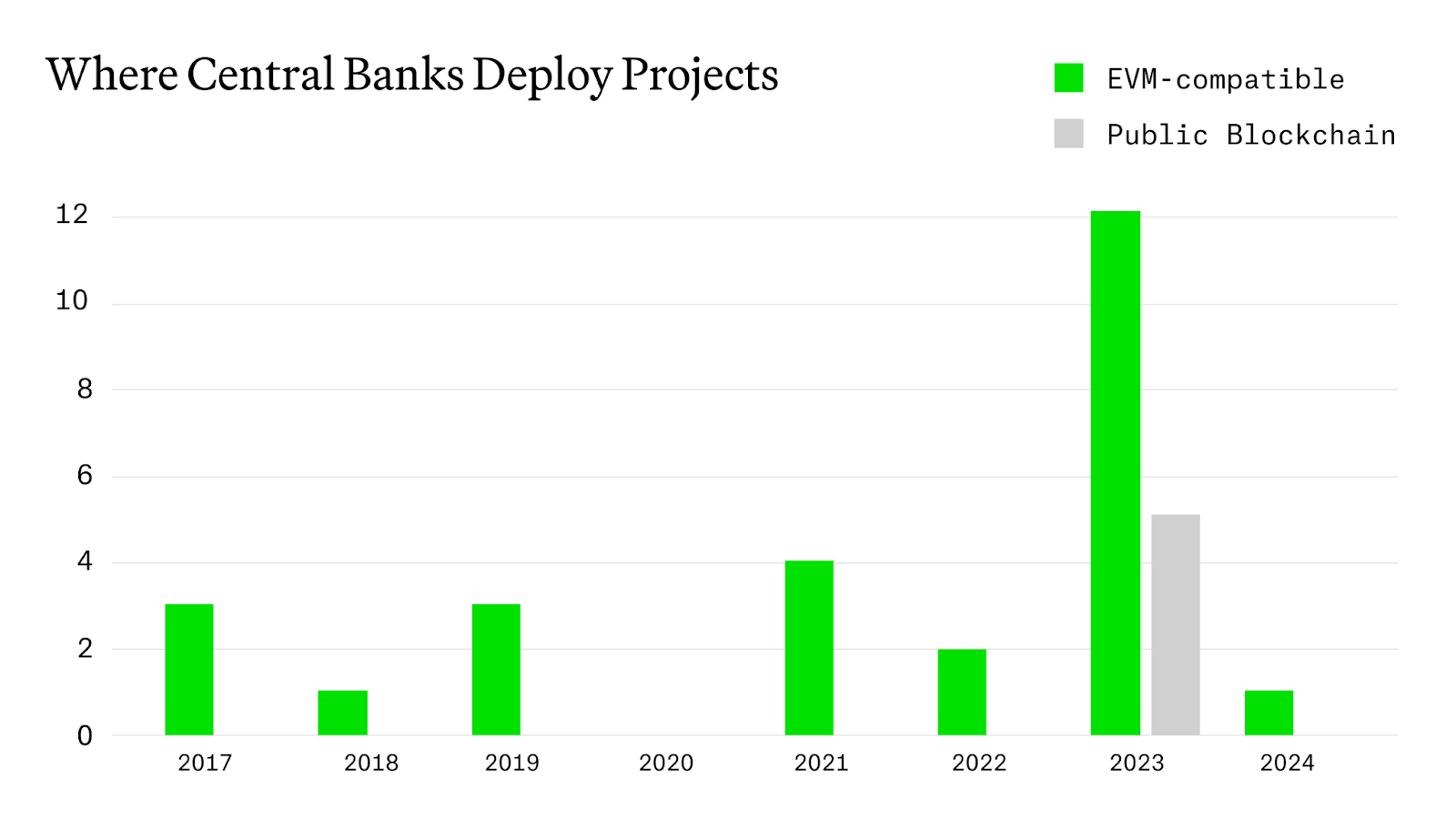

Innovation happens at the edges and eventually gets adopted by incumbents. Accordingly, hampering innovation inevitably reduces the scope of technology that eventually reaches maturity. Even if central banks are skeptical of crypto (and they are), they are still taking battle-tested tech from the permissionless world and using it in their own unique context. If the US government had killed innovation in the information communications technology (ICT) sector, Fedwire messages might still use teletype and Morse Code. To that end, central banks are starting to move past basic CBDC and payments projects and are now looking into tokenization and DeFi. The projects are getting increasingly complex, and more frequently are being deployed on public, permissionless blockchains.

A couple of the most interesting projects, in our view:

- Project Mariana: A cross-border FX project using tokenized central bank money and an AMM on Ethereum’s Sepolia testnet.

- Project Guardian: Three sub-projects looking building liquidity pools, structured notes, and asset-backed securities for trade finance using Ethereum L2s.

It’s too early to see how many projects will be deployed on public networks in 2024, but we suspect that “number go up” from 2023. As noted above, some of the most-innovative projects in this category were launched by the Monetary Authority of Singapore (MAS). The MAS is an undisputed leader in this space, and its work demonstrates that, among other things, deploying a project to a blockchain with a permissionless validator set is not inherently a violation of sanctions laws.

Network effects matter. We believe this is another indication that Ethereum has the strongest developer ecosystem of major L1s today. Anecdotally, we have heard from several tradfi institutions that have ditched proprietary enterprise blockchains in favor of EVM-based blockchains due to the robustness of the developer community (e.g., dev tools, human capital, etc.).

OSS is battle tested. Most of the Internet today runs on Linux-based servers. The future of finance will be no different. One underappreciated benefit of the often-adversarial nature of crypto is that projects deployed to public blockchains (and the blockchains themselves) undergo significant stress testing in the wild—both in terms of security and economic design.

The US is falling behind—but it has an opportunity to create a positive feedback loop. In our sample, the US completed 5 public projects, while Singapore—with substantially smaller capital markets—completed 8 projects (some with additional phases we did not separately record).

On the surface, this looks bad. However, to the extent that other countries continue to leverage EVM-based projects built as OSS, we think the US has an opportunity to lead by being home to many of the most ambitious builders. As US-built tech gets exported to the rest of the world, US values follow. We were particularly excited to see that the NY Fed is already Rust-pilled.

—

This work was supported by a Policy Lab Research Hub grant awarded to Jordan Miller who collected the data (available here, if anyone wants to use or update). If you’re interested in applying for funding to support a policy research project, check out the Policy Lab here.