Paradigm Files Amicus Brief in Coin Center Lawsuit over Tornado Cash Sanctions

TLDR: Paradigm filed an amicus brief in the lawsuit that Coin Center and others brought in Florida to challenge the government’s sanctioning of the Tornado Cash open-source code. Our brief reiterates the simple point we previously made in the Van Loon litigation in Texas: OFAC is authorized to sanction only “people” or “entities,” and their “property.” Tornado Cash fits none of those definitions—it is merely open-source code.

As we have previously outlined in more detail, OFAC’s sanctions rest on the theory that Tornado Cash is an “entity” composed of two loosely affiliated groups that, when joined together, give life to a new Frankenstein-like legal “person.” According to OFAC, the first half of the Tornado Cash “entity” is supposedly composed of the unnamed founders and “associated developers,” which in the context of open-source development, is a highly ambiguous term that could include developers who indirectly contributed to Tornado Cash code. The second half of the “entity” is allegedly the “Tornado Cash DAO,” made up of every TORN token holder.

As our amicus brief argues, OFAC’s theory that Tornado Cash is an unincorporated entity is wrong on the law. None of the developers or tokenholders expressed intent to work towards a common purpose, which is required for the creation of an unincorporated association.

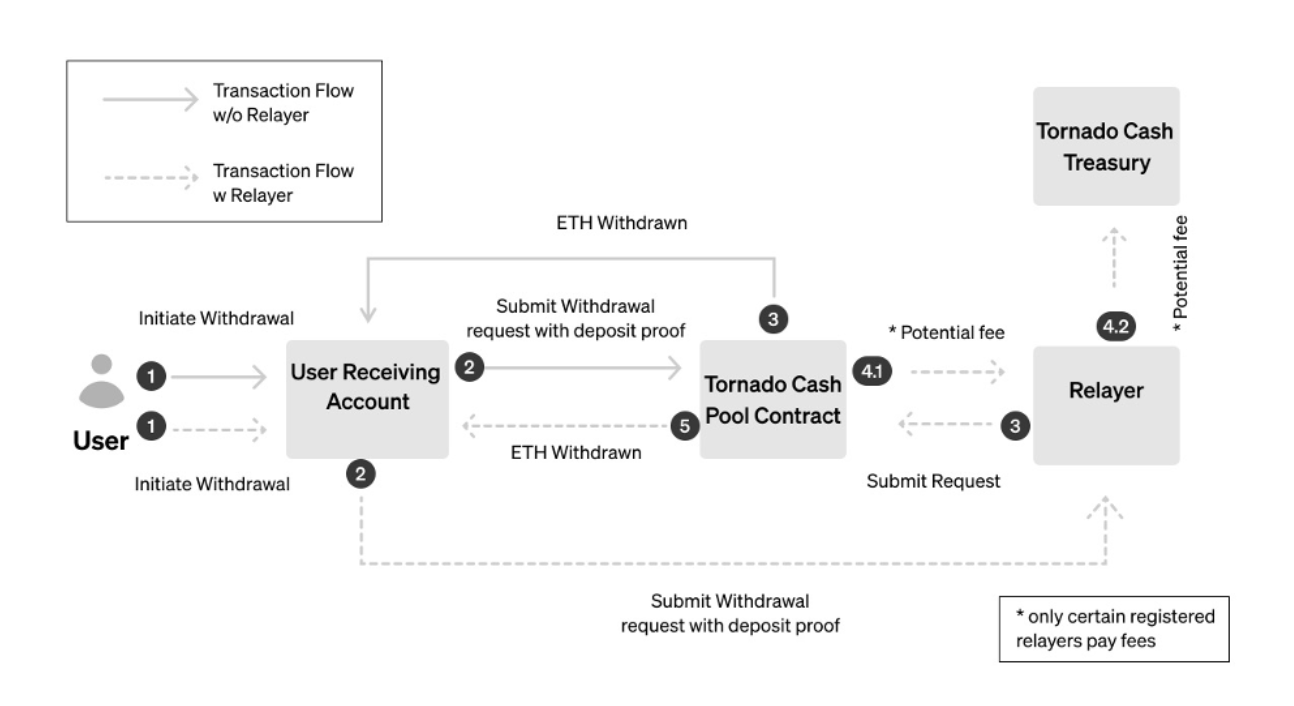

Moreover, in the ongoing Van Loon litigation, OFAC has also previewed a new part of their theory for sanctioning Tornado Cash, which we address for the first time in our latest brief. According to OFAC’s novel argument, the fact that certain registered relayers pay fees to the DAO treasury, means that Tornado Cash has a property interest in the smart contracts.

However, relayers are an optional service that is run by third parties (see transaction flow below). In fact, anyone, including Paradigm, could run a relayer by deploying the publicly available open-source code, and these relayers are not required to pay a fee. The flaw in OFAC’s novel theory is evident when you consider no purported entity can have a property interest in transactions that it will not receive anything from.